Vancouver, one of the largest Canadian states, is known for having the most unaffordable real estate conditions in Canada, and is currently being rated as the most unaffordable in the entire North American market! Fluctuations in Vancouver’s real estate market put it under continuous evaluation and analysis in attempts to provide the residents with educated suggestions on their investments in residential properties. The July/August 2018 residential properties market in Vancouver has been particularly remarkable with abnormal sales rates and price variations.

Summer 2018 Sales Rate in Vancouver

While the summer season is generally known to be a dormant period for the real estate market, this year’s summer sales in Vancouver are significantly lower than previous year’s rates. In fact, the reported values of 2,070 sold properties in July 2018 is the lowest that the market has seen since July 2000. The estimated overall property sales rate in July 2018 has been reported to be 14.6% less than the previous month (June 2018) and around 30.1% less than that of July 2017.

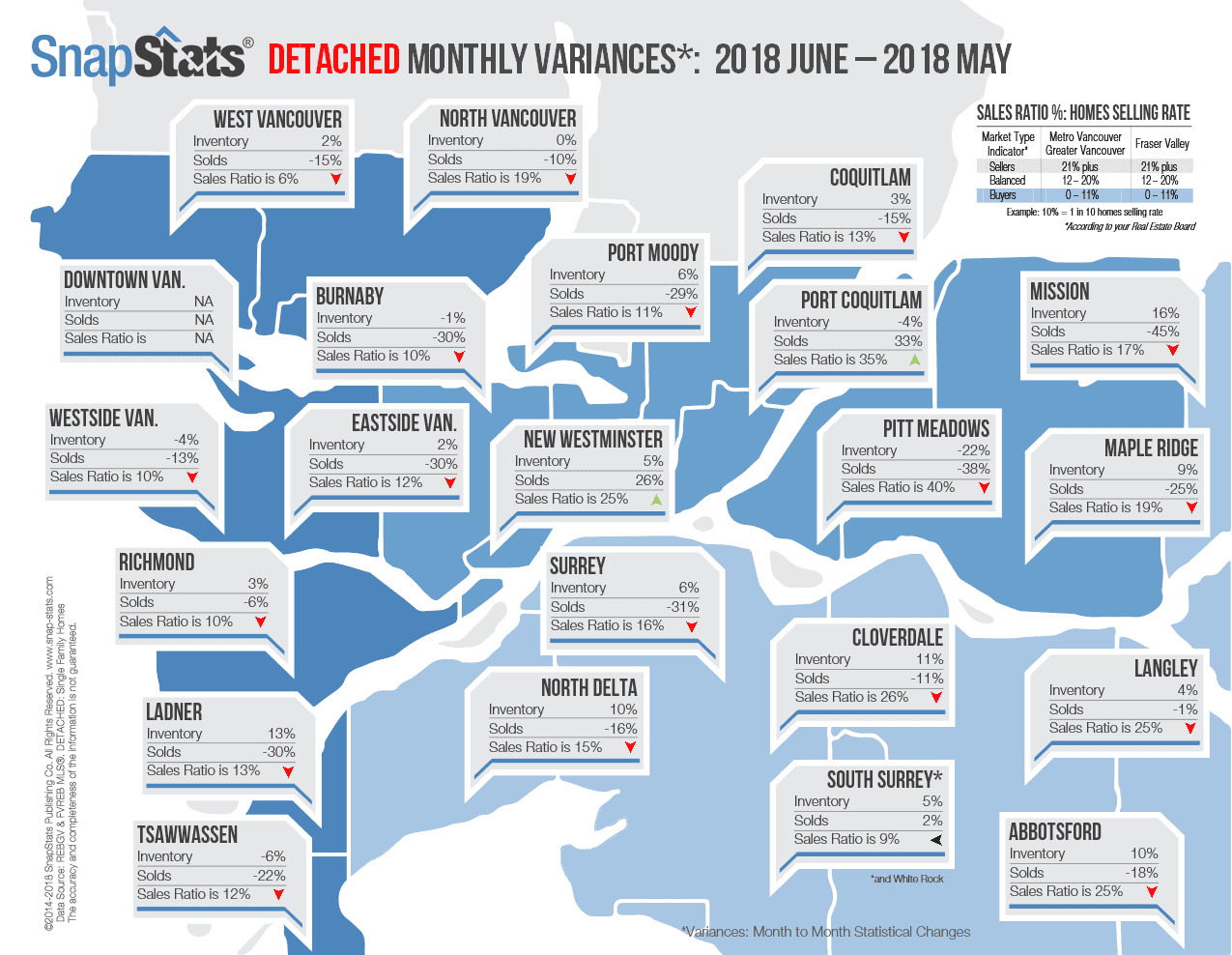

These reduced rates evolve from the decreased demand for the three main types of residential spaces available in Vancouver: the detached homes, townhomes and apartments. The decrease in demand can be resorted to more strict lending requirements and higher mortgage rates and has been particularly observed since the introduction of the Foreign Buyer Tax in 2016. This tax required owners of properties valued between $3M and $4M to pay 0.2% surtax, which is raised to 0.4% for properties valued above $4M.

How much of the Available Properties was Actually sold?

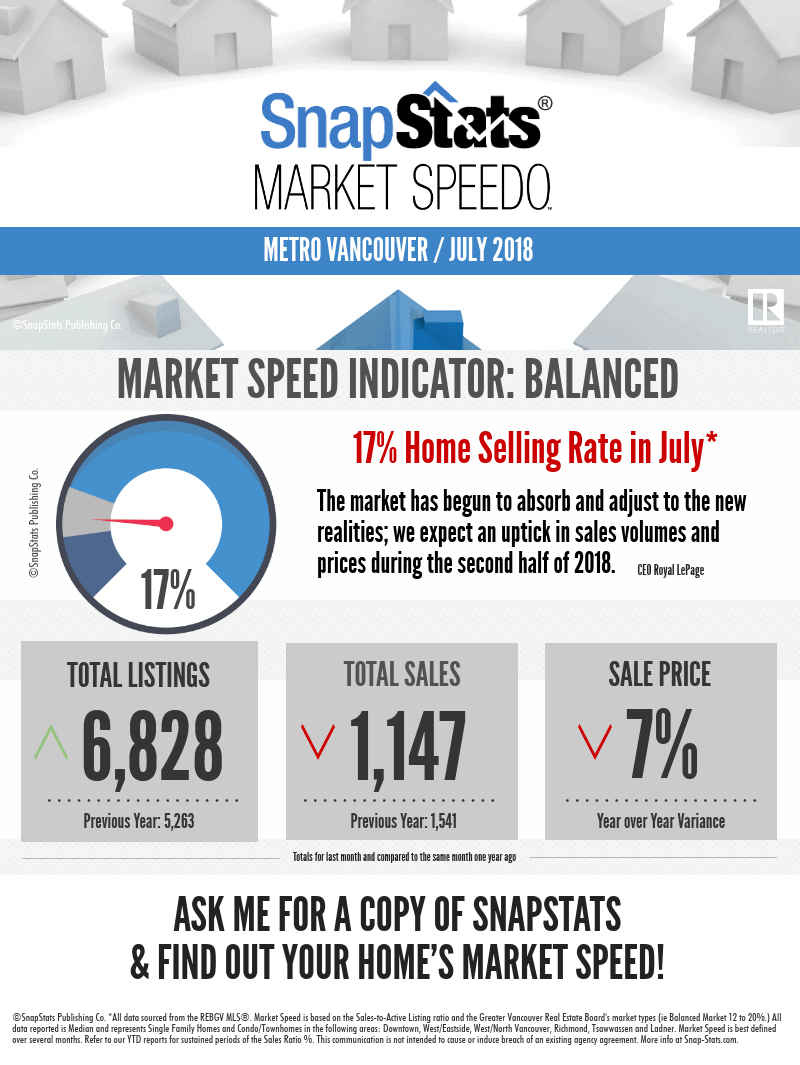

As a result of the low demand, the percentage of residential spaces that were actually sold when compared to the total available houses (also known as Sales-to-Active-Listing Ratio or the Absorption rate) is only 17.1%, such that only 27.3% of the available apartments, 9.9% of the available detached homes and 20.2% of the available townhouses were actually sold over the course of the month. These percentages are the lowest that have been observed in Vancouver’s real estate market over the past 30 years, and detached houses are found to be the most impacted by the low demand.

Did Prices really Change this Summer?

The benchmark price for apartments in July 2018 is 0.5% less than that in June 2018, whereas the percentage is 0.6% for detached homes and 0.4% for attached homes/townhomes. These percentages are however still higher than Summer 2017, but reflect a deceleration in the growth rate. This is the alarming part! A slow growth rate will ultimately lead to ‘negative growth’ which is basically a reduction in prices. This is anyway expected due to the decreased demand, but is influenced by several other factors that impact the market’s supply-demand curves such as the applied surtax and the high mortgage rates. As a result, the majority of buyers are now adopting a “wait and see” approach where they observe the market status for few more months before taking any actions. Hence, houses and apartments are taking longer to be sold and may even require price adjustments.

Have a look at the latest stats by SnapStats