This year the Canadian real estate trends are navigating with uncertainty. Social change and fast-paced technology transform how people work and leave.

The real estate sector faces rising pressure. Hence, they have to respond with new ideas by accelerating digital transformation. Also, being more innovative with deal strategy and rethinking how to address affordability.

People who embrace change and creativity. May find themselves in a position to take advantage of the shifting environment. And also grow with confidence.

Vancouver

Vancouver’s economy is predicted to grow by 2.3 percent in 2019 after seeing a growth of 2.9 percent in 2018. The region’s real estate fundamentals look good, even after years of price increases.

According to interviewees, “Vancouver continues to defy gravity” in terms of commercial prospects. However, the market is yet to come back to earth. As investors are being more cautious and selective, when looking for new opportunities to invest in.

Let’s have a look at the major predictions and trends for Vancouver real estate 2019.

Vancouver housing Prices: Continues To drop

Get ready to see a lot more houses for sale across Vancouver. According to Dane Eitel’s research. Buyers will have more room for breathing in the two years or more, even though overall sales rose in May.

Expected average sales price by 2020 is $ 1.4 million for the detached market, signaling a 20 to 40% drop. Although, there may be other factors that might cause the detached market to go even lower.

Sales have dropped more than $150,000. Resulting, to an environment where the inventory continues to build up. Thus, causing more competition for sellers.

By, the end of 2020, the average cost of a detached house could drop to as low as $ 1.2 million from $ 1.4 million. Because the overall supply will soon be higher than the demand from buyers.

Vancouver Real Estate is a Nutshell

The major concern of developers who are working in Vancouver. Is the affordability for both the buyers and the seller. This year Vancouver has experienced slow residential markets.

Because of a combination of factors such as rising cost of land and construction, uncertainty around new building starts and the need for additional residential inventory. Resulting to profit margins and guarantees of completion becoming increasingly slim.

Industrial inventory is picking upstream in other areas of Vancouver real estate like Blackstone and Amazon. A slowdown is not expected in this sector anytime soon. Suburban real estate is expected to make a quick return. Because of the strong economy in BC with a growing need for new housing.

Developers concerns around a new development in Vancouver can be mitigated by data analysis, collaboration with municipal companies and by long -term planning. Well informed projects on the entry level are most likely to succeed.

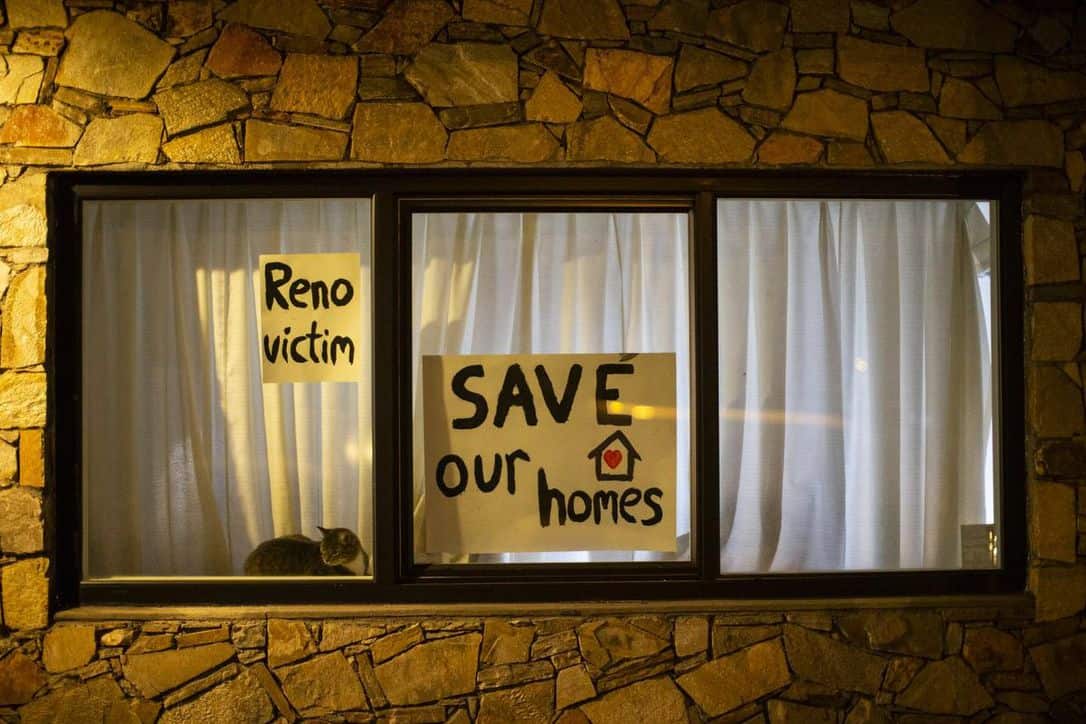

Vancouver City outlines measure to beef up protection for renters

Vancouver city has introduced a new notification system. That will inform Vancouver house renters of their tenancy rights by mail. This is among a series of measures designed to improve renters’ circumstances. That was outlined in a press release issued by the city on February 27.

Almost 53% of Vancouver’s population, represents renters. The renters have been complaining of their predicament in a city whose tight vacancy rate has averaged 0.9% over the last 3 years. Most of the complaint revolves around renovictions and their inability to find affordable places to live. Even after earning reasonable salaries.

Furthermore, the city staff is planning to update the Tenant Relocation and Protection Policy. The staff are consulting with the interest groups and plan to present to the council with an updated policy in June 2019.

The city is working with the provincial government’s Rental Tenancy Board. To improve renter’s protection. Also, to ensure greater transparency is provided to the city staff tenants and the public About whether planned work on rental properties justifies the eviction of tenants.

Rising Construction and Land Costs Create Slim Margins

The demand for residential land still exists in Vancouver. But the intensity has reduced. Because the issue of supply and affordability has made it difficult for buyers to make purchases. Vancouver real estate has experienced high prices over the last few years. Making it difficult for buyers to move on with purchases.

Rising land prices and construction costs make it difficult for developers to fund projects when selling at lower price points. Presale campaigns have always been a crucial part of new development projects. However, their success measure now has a huge impact on accomplishing project financing stage.

These issues are further complicated. By the increasingly long time, it takes for a project to be approved. This drives the costs of pre-development up.

Additionally, it creates uncertainty in the deliverability of projects. Hence, investors and buyers are left wondering whether their will really see the completion of their projects.

Slim margins, lack of trust and the rising cost of land and construction materials. Have created a situation where developers need to shelve projects for lack of financing.